when is income tax season 2022

Economic Impact Payments tax credits and other relief. NEW JERSEY The 2022 tax season is upon us and as W-2s and other tax forms hit US.

2022 Filing Taxes Guide Everything You Need To Know

Changes to the earned income tax credit for the 2022 filing season COVID Tax Tip 2022-31 February 28 2022 The EITC is one of the federal governments largest refundable tax credits for low-to moderate-income families.

. Use USAGovs tax season guide to understand steps you need to take to successfully file by the April 18 deadline. The first day to file 2021 tax returns is Jan. 1 July 2022 to 23 January 2023 Provisional taxpayers including Trusts may file via eFiling or SARS MobiApp.

See If You Qualify and File Today. Higher 401 k Limits. The introduction of auto-assessments among other.

Single or married filing separately. 29 June 2022 The South African Revenue Service SARS has made significant changes to the 2022 Tax Filing Season. After yet another year dominated by COVID-19 and stimulus checks the 2022 tax filing season is finally almost here.

That extra 1000 today should grow to be much more valuable when youre ready to retire. 24 according to the Internal Revenue. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

This is a few weeks earlier than in 2021 when the agency didnt start dealing with individual tax returns until Feb. In 2022 you can contribute 1000 more during the year to your 401 k. Single or married filing separately.

12950 up 400 from 2021. Ad You Can Begin Your 2021 Tax Return Today Even Though the Deadline is Past. 12950 up 400 from 2021.

Step-by-step guidance to help you quickly prepare and file your 2021 tax return. Filing Season 2022 for Individuals Income tax return filing dates 1 July 2022 to 24 October 2022 Taxpayers who file online Taxpayers who cannot file online can do so at a SARS branch by appointment only. State and business taxes in 2022.

Love Island - Season 4 Episode 22 FuLLFREE2022Watch httpsurltvlinkrtKbLove Island Season 4 Episode 22Love Island S4E22Love Island Eps22Love Isla. The standard deduction for each filing status for the 2022 tax year has changed slightly from 2021 according to the IRS. 10 hours agoCBS has picked the Rebels to finish the 2022 season by playing the Kansas State Wildcats in the AutoZone Liberty Bowl in Memphis Tenn.

3 hours agoCovers W-2 income unemployment benefits the earned income tax credit child tax credit standard deduction student loan interest deduction. Single or married filing separately. There are seven federal income tax rates in 2022.

Ad File For Free With TurboTax Free Edition. Mailboxes many in New Jersey will be wondering when they can file and what changes are in store for their returns this year. You need to know the amount of your third stimulus payment you received in.

This is a great way to spend 1000 without it being taxed or counting as income until you use it in retirement. As the federal tax deadline approaches soon you may still have questions about filing your federal state and business taxes in 2022. The standard deduction for each filing status for the 2022 tax year has changed slightly from 2021 according to the IRS.

The recent expansion of this credit means that more people may qualify to have some much-needed money put back in their pocket. Married filing jointly. January 21 2022 1232 PM 6 min read.

This year over 3 million individual non-provisional taxpayers have been auto-assessed by SARS and will not have to file a tax return if they are satisfied with the outcome. The standard deduction for each filing status for the 2022 tax year has changed slightly from 2021 according to the IRS. 12950 up 400 from 2021.

Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539900 for single filers and above 647850 for married couples filing jointly. The IRS announced Monday that itll start accepting and processing tax returns on Jan.

11 Last Minute Tax Tips For Beginners For 2022 Tax Help Tax Refund Tax Season

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022

How To Get Your W2 Form Online For Free 2021 2022

How Small Businesses Can Prepare For Tax Season 2022 In 2022 Business Tax Deductions Business Tax Small Business Tax Deductions

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Throw Me A Parade Tax Season Is Done Shirt Tax Day Graphic Tax Season Design Income Tax Returns Internal Revenue Service Tax Deadline In 2022 Repeat Shirts Shirts Favorite Shirts

Ready For Tax Season Federal Income Tax Guide For 2018 Financeideas Familyfinance Tax Guide Income Tax Federal Income Tax

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

Tax Changes And Key Amounts For The 2022 Tax Year Kiplinger

Canadian Tax Return Deadlines Stern Cohen

Effective Tax Tips To Follow In 2022 Canada 2022 In 2022 Tax Services Tax Preparation Tax

Tax Accountant Mug Income Tax Gag Gift There S No Crying During Tax Season Coffee Cup In 2022 Gag Gifts Tax Season Tax Accountant

Irs Says It S Boosting 2022 Tax Brackets Due To Faster Inflation Tax Brackets Irs Tax

Tax Flyers Tax Services Income Tax Preparation Tax Season Humor

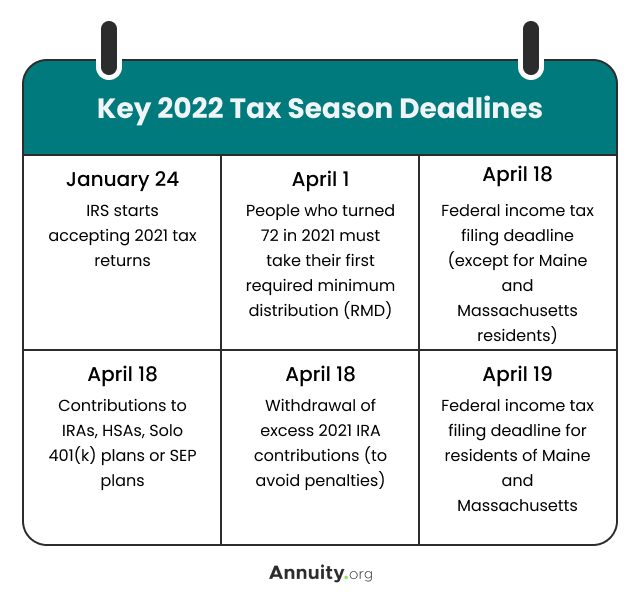

Federal Income Tax Deadlines In 2022

Tax 2022 All The Dates You Need To Know To Avoid 1 110 Fine

2022 Canada Tax Checklist What Documents Do I Need To File My Taxes 2022 Turbotax Canada Tips

How To Calculate Total Income And Tax As Per Normal Provision Vs Sec 115bac Income Tax Calculation Income Tax Tax Income