where's my unemployment tax refund 2020

People who received unemployment benefits last year and filed tax. Will I receive a 10200 refund.

Your employer on the other hand may be eligible for a credit of up to 54 of FUTA taxable wages if.

. This is available under View Tax Records then click the Get Transcript button and choose the. These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022. The IRS has sent 87 million unemployment compensation refunds so far.

Press 2 for questions about your personal income taxes. Unemployment tax refund status. From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per employee.

The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person. The law waived taxes on up to 10200 in 2020 unemployment insurance benefits for individuals who earn less than 150000 a year. The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion.

For eligible taxpayers this could result in a refund a reduced balance due or no change to tax. The IRS has estimated that up to 13 million Americans may qualify. You will get an additional federal income tax refund for the unemployment exclusion if all of the following are true.

Since may the irs has issued more than 87 million unemployment compensation tax. You did not get the unemployment exclusion on the 2020 tax return that you filed. Press 1 for questions about a form already filed or a payment.

The IRS is recalculating refunds for people whose AGI is 150K or below and who filed before the tax law that changed the amount of unemployment that is taxable on a federal return became effective. The American Rescue Plan Act allows eligible taxpayers to exclude up to 10200 up to 10200 for each spouse if married filing jointly from their gross income which will likely lower the tax liability. President Joe Biden signed the pandemic relief law in March.

The IRS has identified 16. Call the IRS at 1---. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer.

My unemployment actually went to my turbo card. The unemployment exclusion would appear as a negative. The 10200 is the amount of income exclusion for single filers not the amount of the refund.

By Anuradha Garg. Why are you getting this. For eligible taxpayers this could result in a refund a reduced balance due or no change to tax.

The IRS began to send out the additional refund checks for tax withheld from unemployment in May. The refunds are being sent out in batchesstarting with the. September 13 2021.

These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt. Here are all the most relevant results for your search about My Unemployment Tax Refund Status. The state of Minnesota had originally taxed the full amount of unemployment that you received in 2020.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000. If you received unemployment in 2020 and filed BEFORE Minnesota changed their law of taxing the unemployment income you may be getting a letter informing you that you will be receiving an additional refund. 22 2022 Published 742 am.

Updated March 23 2022 A1. I have not received my refund for the taxes withheld for unemployment in 2020. They are still working on those refunds which must be processed manually.

The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American Rescue Plan in March. DOF also assesses the value of all New York City properties collects property taxes and other property-related charges maintains property records administers exemption and abatements and collects unpaid property taxes and other property-related charges through annual lien sales. You did not get the unemployment exclusion on the 2020 tax return that you filed.

Another way is to check your tax transcript if you have an online account with the IRS. Eventually sometime in. After this you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued.

Thats the same data. The Department of Labor has not designated their state as a credit. This is available under View Tax Records then click the Get Transcript button and choose the federal tax option.

COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax. Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break. They fully paid and paid their state unemployment taxes on time.

Another way is to check your tax transcript if you have an online account with the IRS. You reported unemployment benefits as income on your 2020 tax return on Schedule 1 line 7. If youre due a refund from your tax year 2020 return you should wait to get it before filing Form 1040X to amend your original tax return.

The IRS is reviewing tax returns filed before the American Rescue Plan Act ARPA of 2021 became law in March 2021 to determine the correct taxable amount of unemployment compensation and tax. Press 3 for all other questions. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes.

The Department of Finance DOF administers business income and excise taxes. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. On September 13th the.

We filed our tax return after March 2020. Check the status of your refund through an online tax account. You did not get the unemployment exclusion on the 2020 tax return that you filed.

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

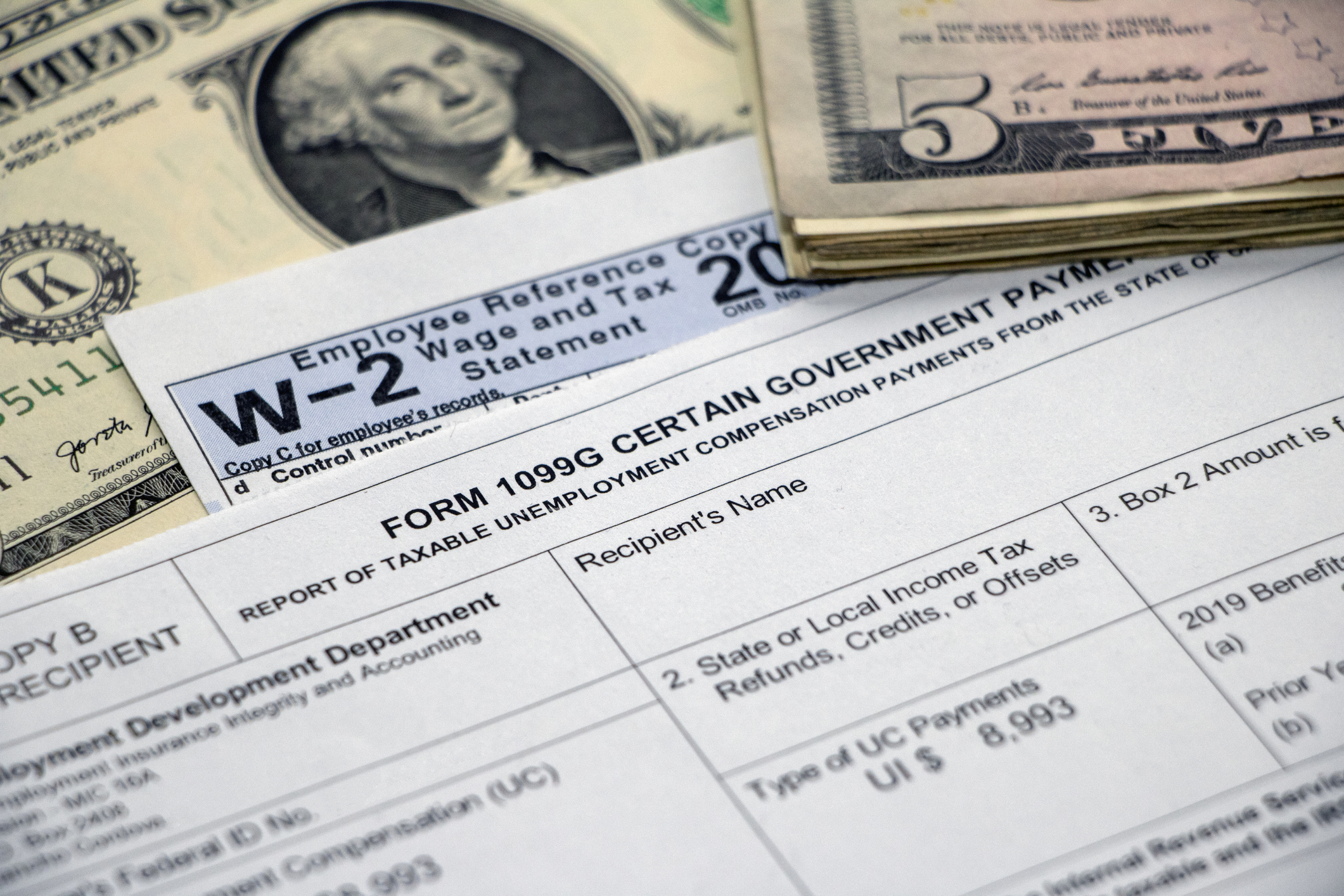

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Where S My Refund Taxpayers Still Waiting For 2020 Irs Return Abc11 Raleigh Durham

Can The Irs Take Or Hold My Refund Yes H R Block

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

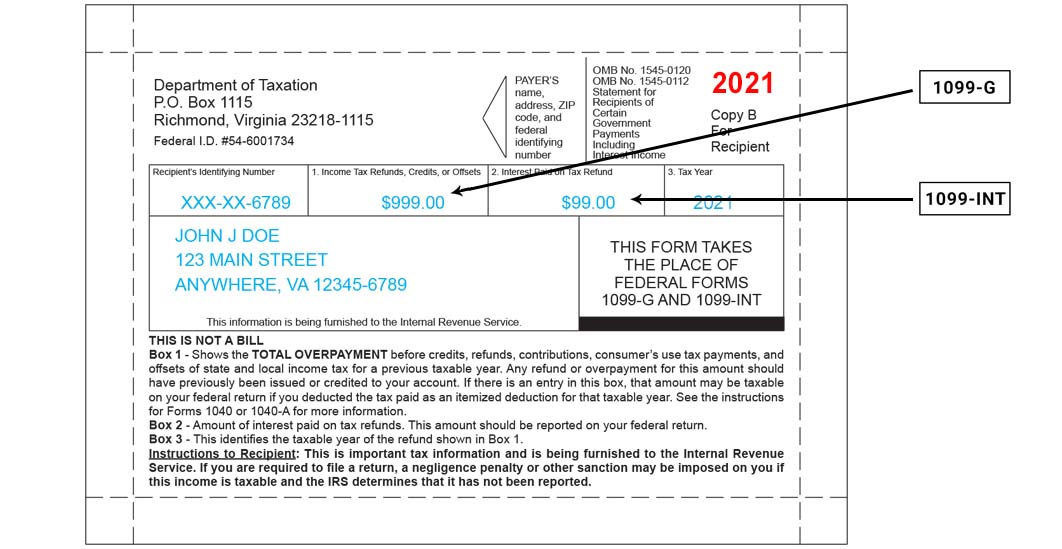

Form 1099 G Certain Government Payments Definition

1099 G Unemployment Compensation 1099g

1099 G 1099 Ints Now Available Virginia Tax

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time